REX Shares & Tuttle Capital Management Announce Forward and Reverse Split of Two ETFs

CONNECTICUT—Dec 13, 2024— REX Shares & Tuttle Capital Management (“T-REX”) have announced the execution of a forward share split of T-REX 2X Long MSTR Daily Target ETF (Ticker: MSTU), as well as a reverse share split of T-REX 2X Inverse MSTR Daily Target ETF (Ticker: MSTZ). The total market value of the shares outstanding will not be affected as a result of these corporate actions, except with respect to the redemption of fractional shares, as outlined below.

Forward Split

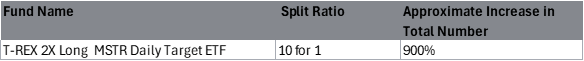

T-REX will execute a forward split of the issued and outstanding shares of T-REX 2X Long MSTR Daily Target ETF (Ticker: MSTU).

After the close of the markets on December 13, 2024, (the “Record Date”), the fund will execute a forward split of the issued and outstanding shares as follows:

As a result of the forward share split, shareholders of the Fund will receive ten shares for each share held of the Fund. Accordingly, the number of the Fund’s issued and outstanding shares will increase by the approximate percentage indicated. The share split will apply to shareholders of record as of the close of CBOE BZX (the “CBOE”) on December 13, 2024 (the “Record Date”). Shares of the Fund will begin trading on the CBOE on a split-adjusted basis on December 16, 2024 (the “Ex-Date”). On the Ex-Date, the opening market value of the Fund’s issued and outstanding shares, and thus a shareholder’s investment value, will not be affected by the share split. However, the per share net asset value (“NAV”) and opening market price on the Ex-Date will be approximately one-tenth of the pre-split value for the Fund.

Illustration of a 10-for-1 Split

Reverse Split

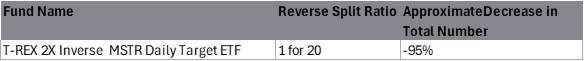

T-REX will execute a reverse split of the issued and outstanding shares of the T-REX 2X Inverse MSTR Daily Target ETF (Ticker: MSTZ).

After the close of the markets on December 13, 2024, the reverse split of the Fund’s issued and outstanding shares will be as follows:

As a result of the reverse split, every twenty shares of the Fund will be exchanged for one share. Accordingly, the total number of the issued and outstanding shares for the Fund will decrease by the approximate percentage indicated. The share split will apply to shareholders of record as of the close of CBOE BZX (the “CBOE”) on December 13, 2024 (the “Record Date”). Shares of the Fund will begin trading on the CBOE on a split-adjusted basis on December 16, 2024 (the “Ex-Date”). On the Ex-Date, the opening market value of the Fund’s issued and outstanding shares, and thus a shareholder’s investment value, will not be affected by the share split. However, the per share net asset value (“NAV”) and opening market price on the Ex-Date will be approximately twenty times the pre-split value for the Fund.

Illustration of a 1-for-20 Reverse Split

Units Transfer

The Trust’s transfer agent will notify the Depository Trust Company (“DTC”) of the splits and instruct DTC to adjust each shareholder’s investment(s) accordingly. DTC is the registered owner of the Funds’ shares and maintains a record of the Funds’ record owners.

About REX Financial:

REX Financial is an innovative ETP provider specializing in alternative-strategy ETFs and ETNs, with over $10 billion in assets under management. REX is renowned for creating MicroSectors™ and co-creating the T-REX product lines of leveraged and inverse tools for traders and recently launched a series of option-based income strategies.

About Tuttle Capital Management (TCM):

Tuttle Capital Management is an industry leader in offering thematic and actively managed ETFs. TCM utilizes informed agility when managing portfolios, an approach that, from an informed standpoint, can assess and blend effective elements from multiple investment styles, and, from a position of agility, aims to stay in harmony with market trends without being too passive or too active. Please visit www.tuttlecap.com for more information.

-

For media inquiries, please contact:

Gregory FCA for REX Shares

rexshares@gregoryfca.com

-

Matthew Tuttle for Tuttle Capital Management

Investors should consider the investment objectives, risk, charges, and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the T-REX ETFs please call 1-844-802-4004 or visit our website at rexshares.com. Read the prospectus and summary prospectus carefully before investing.

There is no guarantee that the Funds will achieve their investment objectives. Investing involves risk, including possible loss of principal.

MSTU and MSTZ are not suitable for all investors. The Funds are designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily leverage (2X/-2X) investment results, understand the risks associated with the use of leverage and are willing to monitor their portfolios frequently. Investing in the funds is not equivalent to investing directly in MSTR as the fund will generally hold 0% of underlying shares of MSTR.

Because of daily rebalancing and the compounding of each day’s return over time, the return of the Fund for periods longer than a single day will be the result of each day’s returns compounded over the period, which will very likely differ from 200% of the return of the underlying security over the same period. The Fund will lose money if the underlying security performance is flat over time, and as a result of daily rebalancing, the underlying security’s volatility and the effects of compounding, it is even possible that the Fund will lose money over time while the underlying security’s performance increases over a period longer than a single day.

The Funds’ investment adviser will not attempt to position each Fund’s portfolio to ensure that a Fund does not gain or lose more than a maximum percentage of its net asset value on a given trading day. As a consequence, if a Fund’s underlying security moves more than 50%, as applicable, on a given trading day in a direction adverse to the Fund, the Fund’s investors would lose all of their money.

The T-REX Strategies ETFs are sponsored by REX Advisers LLC and are distributed by Foreside Fund Services, LLC, member FINRA. Foreside Fund Services is not affiliated with REX Advisers, REX Shares or Tuttle Capital Management LLC.

© Copyright 2024 REX Shares. All rights reserved.