Alphabet Q3 2024 Earnings: Everything You Need to Know

Date: 10/29/2024, After Market Close

Introduction

In Alphabet’s upcoming Q3 earnings, analysts and investors will look for revenue trends in Google Search and YouTube, as well as cloud business growth and AI spending. Another area of focus includes Alphabet's driverless taxi service Waymo, which served over 2 million users as of last quarter. Regulatory concerns surround Alphabet, especially those concerning antitrust scrutiny and privacy issues affecting its core businesses. Now let's get into more details on Alphabet's business down below.

Alphabet Inc.’s Fundamentals

Alphabet’s core advertising segments are expected to deliver solid growth, with Google Search Ads—representing 57% of Q2 revenues—projected to grow 11.46% YoY. YouTube Ads, which contributed 10% of Q2 revenues, are similarly anticipated to see an 11.78% YoY increase, driven by strong user engagement, with Monthly Active Users for Q3 estimated at 3.07 billion. Google Cloud, an increasingly crucial revenue driver, is forecasted to grow 28% YoY as the company continues expanding its cloud capabilities to meet demand from enterprise clients.

Artificial Intelligence

Alphabet’s AI momentum looks set to continue; AI-powered Search Overviews have seen strong traction among younger users, with further optimizations likely to enhance ad placements around AI-generated results. Google Cloud which is expected to receive NVIDIA's Blackwell platform in early 2025, crossed $10 billion in revenue at the end of last quarter, and is expected to sustain its growth as generative AI solutions gain popularity among developers. Updates on Gemini—Alphabet’s flexible AI model now integrated across Search, Workspace, and Google Messages—could also highlight the company’s continued push into AI-driven functionality. With fresh investments in AI infrastructure, including a more powerful sixth-generation TPU, Alphabet should continue to position itself to meet the rising demand for AI capabilities.

Regulatory Concerns Loom

Alphabet faces a couple regulatory challenges that threaten its dominance in key markets, as both antitrust and public interest lawsuits target its business practices. Recently, Alphabet’s YouTube was named in cases brought by school districts and local governments over claims that the platform encourages addictive behavior harmful to minors. Simultaneously, Alphabet faces a landmark antitrust ruling over its search engine monopoly, with the Department of Justice pushing for structural changes, including potentially divesting assets like Chrome or Android to foster competition. Additional court orders are also reshaping Google Play, mandating more openness to competitor platforms.

Looking Ahead

Alphabet’s growth strategy now includes their driverless vehicle unit Waymo, which just recently closed a $5.6 billion funding round to expand its robotaxi services in key U.S. cities. As Alphabet balances this expansion with core ad, cloud growth, and AI innovation, investors will continue to watch revenue potential and the company’s ability to navigate regulatory pressures. A strong earnings report and proactive steps can continue to solidify Alphabet’s market leadership.

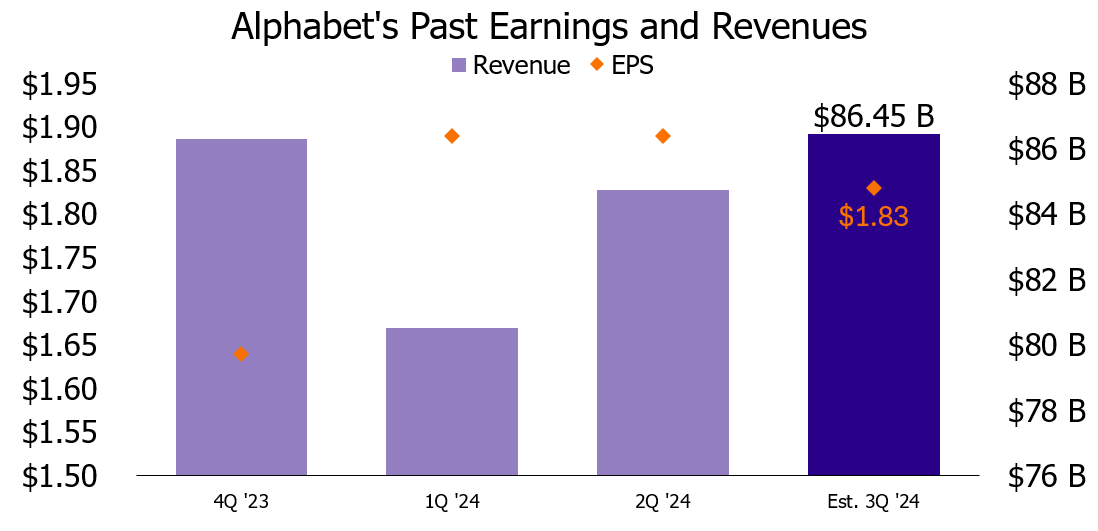

Q3 Earnings Estimates

Adjusted EPS: $1.83

YoY EPS: $1.55

Q3 Revenue Estimates

Revenue: $86.45B

YoY Revenue: $76.69B

*Estimates and Data retrieved from Bloomberg 10/15/2024

The T-REX 2X Long Alphabet Daily Target ETF (the “Fund”) seeks daily leveraged investment results and is very different from most other exchange-traded funds. As a result, the Fund may be riskier than alternatives that do not use leverage because the Fund’s objective is to magnify (200%) the daily performance of the publicly-traded common stock of Alphabet Inc. (NASDAQ: GOOG).

The Fund seeks daily investment results, before fees and expenses, of 200% of the daily performance of GOOG. The Fund does not seek to achieve its stated investment objective for a period of time different than a trading day.

Investing in the Funds is not equivalent to investing directly in GOOG.

A link to the funds prospectus can be found here. Click here for fund holdings.

Important Information:

PERFORMANCE DISCLOSURE

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. Returns for performance for one year and under are cumulative, not annualized. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. For additional information, see the fund(s) prospectus.

Shares of the REX Shares ETFs are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

AFTER-TAX AND AFTER-TAX, POST SALES RETURNS

Tax-adjusted returns and tax cost ratio are estimates of the impact taxes have had on a fund. We assume the highest tax rate in calculating these figures. These returns follow the SEC guidelines for calculating returns before sale of shares. Tax-adjusted returns show a fund’s annualized after tax total return for the one, three and five year periods, excluding any capital-gains effects that would result from selling the fund at the end of the period. To determine this figure, all income and short-term capital gains distributions are taxed at the maximum federal rate at the time of distribution. Long-term capital gains are taxed at a 15% rate. The after tax portion is then assumed to be reinvested in the fund. State and local taxes are not included in our calculations. For more information, please consult your tax consultant.

|

INVESTMENT RISKS Investing in the Funds involves a high degree of risk. As with any investment, there is a risk that you could lose all or a portion of your investment in the Funds. An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the REX Shares. To obtain a Fund’s prospectus and summary prospectus call 844-802-4004. A Fund’s prospectus and summary prospectus should be read carefully before investing. Investing in a REX Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by a Fund increases the risk to the Fund. The REX Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged, or daily inverse leveraged, investment results and intend to actively monitor and manage their investment. Fixed Income Securities Risk. When the Fund invests in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund. Effects of Compounding and Market Volatility Risk. The Fund has a daily leveraged investment objective and the Fund’s performance for periods greater than a trading day will be the result of each day’s returns compounded over the period, which is very likely to differ from the Fund performance, before fees and expenses. Leverage Risk. The Fund obtains investment exposure in excess of its net assets by utilizing leverage and may lose more money in market conditions that are adverse to its investment objective than a fund that does not utilize leverage. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. Investing in derivatives may be considered aggressive and may expose the Fund to greater risks, and may result in larger losses or small gains, than investing directly in the reference assets underlying those derivatives, which may prevent the Fund from achieving its investment objective. Indirect Investment Risk. Alphabet Inc. is not affiliated with the Trust, the Adviser or any affiliates thereof and is not involved with this offering in any way, and has no obligation to consider the Fund in taking any corporate actions that might affect the value of the Fund. Indirect Investment Risk. The Fund will be concentrated in the industry to which Alphabet Inc. is assigned (i.e., hold more than 25% of its total assets in investments that provide inverse exposure to the industry to which Alphabet Inc. is assigned). Counterparty Risk. A counterparty may be unwilling or unable to make timely payments to meet its contractual obligations or may fail to return holdings that are subject to the agreement with the counterparty. Shorting Risk. A short position is a financial transaction in which an investor sells an asset that the investor does not own. In such a transaction, an investor’s short position appreciates when a reference asset falls in value. Liquidity Risk. Holdings of the Fund may be difficult to buy or sell or may be illiquid, particularly during times of market turmoil. Illiquid securities may be difficult to value, especially in changing or volatile markets. Non-Diversification Risk. The Fund is classified as “non-diversified” under the Investment Company Act of 1940, as amended. This means it has the ability to invest a relatively high percentage of its assets in the securities of a small number of issuers or in financial instruments with a single counterparty or a few counterparties. New Fund Risk. As of the date of this prospectus, the Fund has no operating history and currently has fewer assets than larger funds. Like other new funds, large inflows and outflows may impact the Fund’s market exposure for limited periods of time. Technology Sector Risk. Market or economic factors impacting technology companies and companies that rely heavily on technological advances could have a major effect on the value of the Fund’s investments. The value of stocks of technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs. Alphabet Inc. Investing Risk— Alphabet Inc. faces risks associated with companies in the information technology sector, Alphabet Inc.’s Class A shares face risks associated with reliance on advertising revenue and the effect that loss of partners or new and existing technologies that block advertisements online may have on its business; intense competition for its products and services across different industries; investments in new businesses, products, services and technologies that may divert management attention or harm its financial condition or operating results; slowdowns in its revenue growth rate; the ability to protect its intellectual property rights; the ability to maintain or enhance its brands and its impact on the ability to expand its user base, advertisers, customers, content providers and other partners; manufacturing and supply chain issues; interruptions to, or interferences with, its complex information technology and communication systems; its international operations; failure to evolve with the advancement of technology and user preferences; data privacy and security concerns; regulatory, and legal and litigation issues. Important Information Regarding 2X GOOX Fund. The T-REX 2x Long Alphabet Daily Target ETF (GOOX) seeks 2X% daily leveraged investment results and thus will have an increase of volatility relative to the GOOG performance itself. Longer holding periods, higher volatility of GOOG and leverage increase the impact of compounding on an investor’s returns. During periods of higher volatility, the volatility of GOOG may affect the fund’s performance. Sector Concentration Risk. The trading prices of the Fund’s underlying securities may be highly volatile and could continue to be subject to wide fluctuations in response to various factors. The stock market in general, and the market for technology companies in particular, where applicable, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies. Call Writing Strategy Risk. The path dependency (i.e., the continued use) of the Fund’s call writing strategy will impact the extent that the Fund participates in the positive price returns of the underlying reference securities and, in turn, the Fund’s returns, both during the term of the sold call options and over longer time period. High Portfolio Turnover Risk. The Fund may actively and frequently trade all or a significant portion of the Fund's holdings. A high portfolio turnover rate increases transaction costs, which may increase the Fund's expenses. Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price. NAV: The dollar value of a single share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day. Distributor: Foreside Fund Services, LLC, member FINRA, not affiliated with REX Shares or the Funds’ investment advisor. |