FEPI: One Year In

Celebrating One Year of Innovation with the REX FANG & Innovation Equity Premium Income ETF: FEPI

In October 2023, REX Shares proudly launched the REX FANG & Innovation Equity Premium Income ETF, FEPI, marking a new era for income-focused investors. Designed to provide exposure to 15 of the largest U.S. technology companies, FEPI combines the growth potential of large-cap tech with a covered call strategy that focuses on single stock options to help provide income.

Big Tech in Review

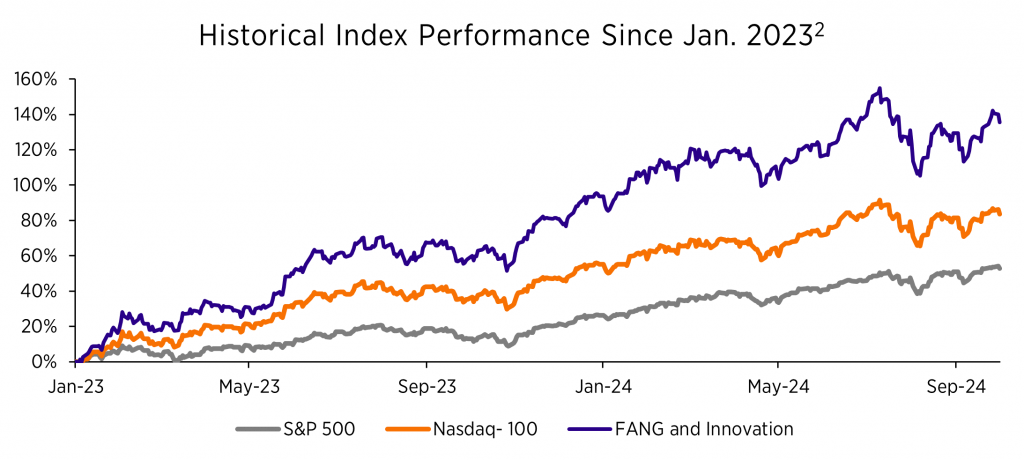

As we mark FEPI’s one-year birthday, it’s worth reflecting on the market forces that shaped the tech sector over the past year. Since FEPI’s inception in October of 2023, the tech sector saw strong growth, driven by the AI boom led by companies like NVIDIA1. However, by late summer 2024, the sector faced challenges as uncertainty around Federal Reserve interest rate decisions, geopolitical tensions in the Middle East, and the upcoming U.S. elections triggered broader market downturns. These headwinds have slowed the market’s momentum and heightened the recent historically suppressed volatility.

1NVIDIA has a 7.35% weighting in FEPI as of 10/09/2024.

2Bloomberg as of 10/1/24. Past performance and is no guarantee of future results Index performance is not illustrative of fund performance. One cannot invest directly in an index.

How FEPI Navigated the Market

Amid these market fluctuations, FEPI demonstrated its resilience by capitalizing on opportunities within the tech sector while maintaining a focus on income generation through its covered call strategy. Investors seeking returns found value in FEPI’s approach, which positioned it to perform even as broader market uncertainties loomed.

Sustaining Distributions

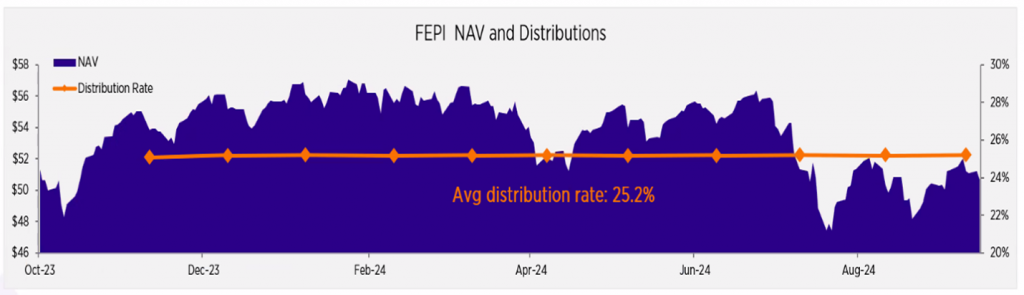

While maintaining NAV is important, the key driver of FEPI’s strategy has been its monthly distributions. Despite market headwinds, FEPI has delivered payouts through its covered call strategy. We believe this approach may not only generate reliable income but also offers a buffer against market volatility.

FEPI has maintained an average distribution rate of 25.20%* and a 30-Day SEC yield of -0.18%**, even as its NAV fluctuated with broader market trends.

*As of 9/25/2024. **As of 9/30/2024

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Click here for standardized performance. Find the FEPI prospectus here.

*As of 09/25/2024. The Distribution Rate is the annual yield an investor would receive if the most recently declared distribution, which includes option income, remained the same going forward. The Distribution Rate is calculated by multiplying an ETF’s Distribution per Share by twelve (12), and dividing the resulting amount by the ETF’s most recent NAV. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. Current distributions consist of 99.54% estimated return of capital (ROC). For full details on the composition of distributions, please refer to the latest 19a-1 notice.

**As of 9/30/2024 The 30-Day SEC Yield represents net investment income, which excludes option income, earned by such ETF over the 30-Day period, expressed as an annual percentage rate based on such ETF’s share price at the end of the 30-Day period. The REX FANG & Innovation Equity Premium Income ETF has a gross expense ratio of 0.65%. Distributions are not guaranteed.

FEPI’s Impressive AUM Achievement

FEPI was the fourth fastest U.S. covered call ETF to surpass $100 million in AUM. Now, nearly a year after its launch, the fund has reached an impressive $389 million in assets under management.

1,2Bloomberg as of 10/1/24

The Path Ahead

As FEPI celebrates its first birthday, the fund has delivered both strong growth and consistent income for investors. Through impressive distributions and achievements, FEPI quickly became a standout in the covered call ETF space as the fund offered exposure to domestic innovation and income.

Important Information

Investing in the Fund involves a high degree of risk. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus. Please read the prospectuses carefully before you invest. Investments involve risk. Principal loss is possible. For FEPI prospectuses, [Click here] or call 1-844-802-4004.

THE FUND, TRUST, ADVISER, AND SUB-ADVISER ARE NOT AFFILIATED WITH THE FUND’S UNDERLYING SECURITIES.

The Fund’s investment exposure is concentrated in the same industries as that assigned to the underlying securities. Some or all of these risks may adversely affect the Fund’s net asset value (“NAV”) per share, trading price, yield, total return, and/or ability to meet its investment objective. The value of the Fund, which focuses on underlying securities in the technology sector, may be more volatile than a more diversified pooled investment or the market as a whole and may perform differently from the value of a more diversified pooled investment or the market as a whole.

Sector Concentration Risk. The trading prices of the Fund’s underlying securities may be highly volatile and could continue to be subject to wide fluctuations in response to various factors. The stock market in general, and the market for technology companies in particular, where applicable, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies.

Liquidity Risk. Some securities held by the Fund, including options contracts, may be difficult to sell or be illiquid, particularly during times of market turmoil.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other ordinary investments, including risk related to the market, imperfect correlation with underlying investments or the Fund’s other portfolio holdings, higher price volatility, lack of availability, counterparty risk, liquidity, valuation and legal restrictions.

Call Writing Strategy Risk. The path dependency (i.e., the continued use) of the Fund’s call writing strategy will impact the extent that the Fund participates in the positive price returns of the underlying reference securities and, in turn, the Fund’s returns, both during the term of the sold call options and over longer time period. High Portfolio Turnover Risk. The Fund may actively and frequently trade all or a significant portion of the Fund’s holdings. A high portfolio turnover rate increases transaction costs, which may increase the Fund’s expenses.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

Non-Diversification Risk. Because the Fund is non-diversified, it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it was a diversified fund.

Options Contracts. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility of the underlying reference security, the time remaining until the expiration of the option contract and economic events. For the Fund in particular, the value of the options contracts in which it invests are substantially influenced by the value of the underlying securities.

Money Market Securities Risk. The Fund may invest in money market securities, which are short-term, highly rated fixed income securities. Although money market securities typically carry lower risk than equity securities, return of principal and interest may not be guaranteed.

Funds distributed by: Foreside Fund Services, LLC, not affiliated with Rex Shares, LLC.