Key Benefits Of ETFs

There are many great investment tools available for investors to reach their objectives. Choice, as every consumer knows, is wonderful, but understanding the various options is important.

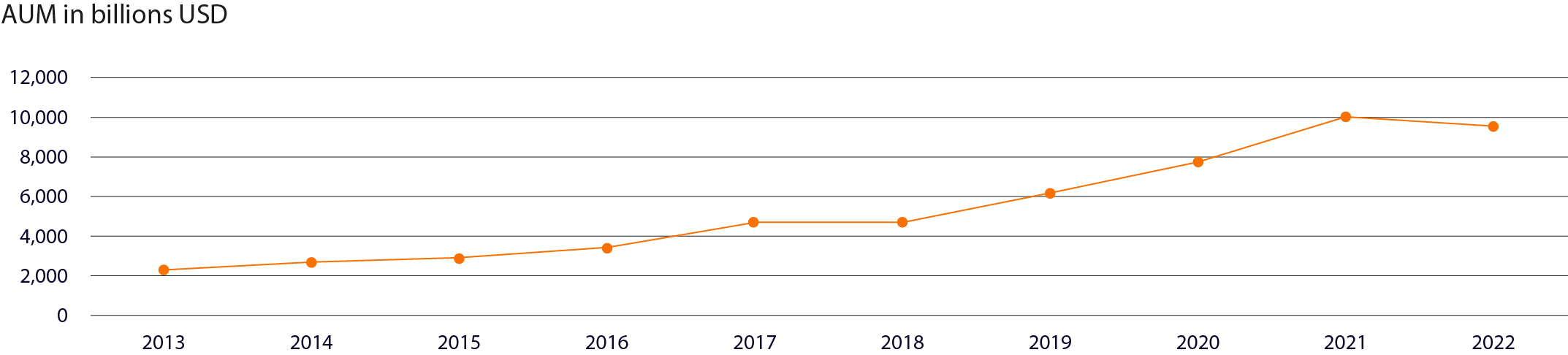

For millions of people the right option continues to be exchange traded funds (ETFs). From humble beginnings in the 1990s, ETFs have become a veritable juggernaut in the world of investments. The exchange traded fund is a transformational vehicle, and its crucial benefits have won over both individuals and institutions alike.

Diversify Your Portfolio

We’ve all heard the adage, “Don’t put all your eggs in one basket.” In an investment context, this advice speaks to the importance of being properly diversified. Diversification can enhance risk-adjusted returns over time, protecting a portfolio against a sharp drop in one holding or asset class. Exchange traded funds can offer compelling benefits in terms of diversification. From an asset allocation standpoint, owning ETFs can complement and augment the other building blocks of an investor’s portfolio—whether that’s cash or cash equivalents, individual securities (equities or fixed income), or alternative investments (e.g. private equity, hedge funds, real estate, etc.).

Meanwhile, exchange traded funds allow for diversification because they offer investors access to such a wide range of stocks and bonds. There are ETFs that seek to track broad market indices (such as the Nasdaq-100®), strategies that complete parts of a portfolio such as value, growth, or income, as well as funds that focus on specific countries or sectors. Each investor

can buy the mix of ETFs that helps to meet their unique needs and objectives.

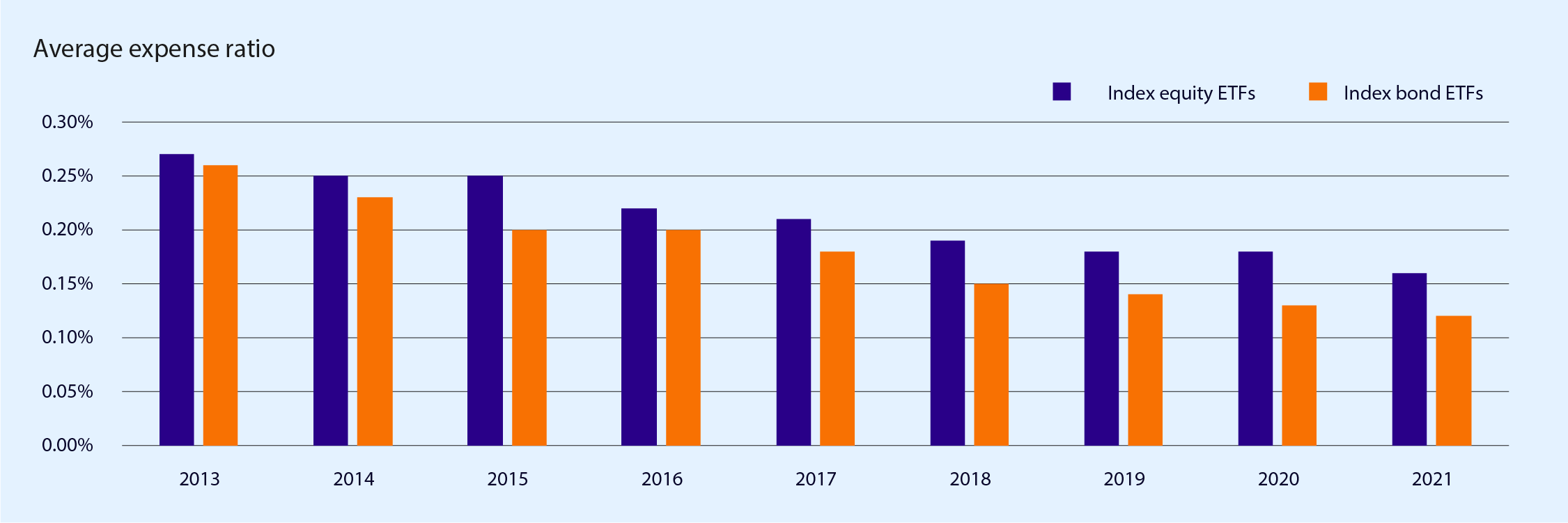

Individual and institutional investors can also choose from passive and active exchange traded funds. Passive ETFs buy and hold a basket of securities, which are typically representative of an index, sector, or country. Unlike, say, a traditional active mutual fund, a passive ETF does not have portfolio managers who aim to buy certain securities (and avoid others) in a quest for outperformance. These types of ETFs often sport ultra-low fees, as the fund provider doesn’t need to maintain expensive teams of analysts and portfolio managers.

While passive funds still dominate the ETF space, investors now have increasing access to actively managed exchange traded funds. These function in the same way as traditional (i.e. passive) ETFs but have professional managers at the helm buying and selling in a bid to outperform an index or other benchmark. Active ETFs do tend to come with somewhat higher fees, but they also have the potential of outperforming their benchmark.

Low Cost and Easy Access

Two features that have made ETFs so popular are their low fees and their ease of access. Take cost, for starters. Compared to mutual funds, exchanged traded funds have rock-bottom management expense ratios (MERs).

ETF fees usually range from around 0.1%-0.45%, depending on the strategy and whether they are passively or actively managed.

ETFs are also super-easy to access. Anyone with a brokerage account (whether it’s self-directed or through an advisor) can buy and sell ETFs. Indeed, with online trading, this can literally be done with the click of a few buttons. What’s more, the management fees associated with owning an ETF tend to be very inexpensive. To use a simplified example, an investor who buys $10,000 of an ETF with a 0.1% management expense ratio would pay $10 to the fund provider each year. Trading costs (which are paid to an investor’s broker) are a separate cost.

Exchange traded funds are accessible in another way as well: there’s no minimum purchase. This makes them ideal for individuals who are just starting to build a portfolio. Mutual funds, on the other hand, typically require a minimum investment.

Intra-Day Trading

Another advantage of ETFs is that you can buy and sell them throughout the trading day. So, while we don’t recommend attempting to time the market, you do have the ability to respond to market changes as they happen. Intra-day trading is also crucial because it allows investors to buy and sell a holding instantaneously. This allows you, for instance, to quickly raise funds if you spot another investment opportunity.

You don’t have to wait for the close of trading to know the price you’ll receive, either.

Intra-day trading is available for all ETFs, including those that trade less frequently. For those ETFs, which can have more price fluctuations, it is best practice to use a limit order or wait until after the market has been open for an hour or so.

Tax Efficiency

Returns matter for investors, but what really matters are after-tax returns. Fortunately, the way exchange traded funds are designed can help minimize the taxes paid by investors holding the ETF. Without going into too many details, ETFs can engage in ‘in kind’ transactions for their underlying securities, which avoid the realization of capital gains. This leads to lower capital gains taxes pay able for those who hold an ETF in their portfolio. So, while investors will still realize capital gains for the increase in their purchase price vs. their sale price, trading activity

within the ETF likely won’t have any tax implications.

Price Efficiency

Price matters. Whether you’re buying a sweater, a car, or an ETF, you want to feel confident that you won’t pay more than something is currently worth or sell for less than you could get. The good news is that exchange traded funds have two mechanisms that contribute to the price efficiency. First, each ETF has one or more designated Authorized Participants. These are typically brokerage firms or other trading companies. Authorized Participants may deal both in a given ETF, as well as that ETF’s underlying assets—creating and redeeming units of a fund in the process.

If the market price of an ETF is trading at a discount to its Net Asset Value (NAV)*, an Authorized Participant (AP) can deliver units of the ETF to the fund’s provider, taking the ETF’s basket of securities in return. On the flip side, if an ETF is trading at a premium to its NAV, an AP can profit by doing the reverse: Buying securities and delivering them to the fund provider in exchange for ETF units. This kind of arbitrage is profitable for the Authorized Participant and brings the market price of a fund in line with its value.

A second layer of price efficiency in ETFs arises due to the actions of what are known as Market Makers. Market Makers are trading firms designated to provide liquidity when required. These firms post bid and ask quotes throughout the trading day, giving prospective buyers and sellers the ability to trade in an ETF. As with Authorized Participants, Market Makers can help arbitrage away any significant premium or discount in an ETF relative to its underlying NAV—buying if an ETF is trading at a discount and selling if it’s trading at a premium.

Transparency—Know What You Own

A final but still crucial benefit of ETFs is their transparency. In other words, investors know what they’re buying, and they know what they’re selling. ETFs differ in the amount of transparency they provide, but in both cases, there is sufficient disclosure for someone to make an informed decision.

Fully transparent ETFs publish their complete list of holdings daily. That means the market knows at the end of each trading day which securities an ETF owns—and exactly how many. Semi-transparent ETFs, on the other hand, shield some level of detail to protect their investment process. To facilitate transparency, these funds publish what is known as an indicative NAV. Usually updated every 15 seconds throughout the trading day, an indicative NAV tells the market what a fund’s underlying holdings are worth. Semi-transparent ETFs also publish a proxy basket for Market Makers: While not a fund’s actual portfolio holdings, this basket is designed to be sufficiently representative so as to encourage trading firms to keep providing liquidity to the market.

A Note on Notes

This primer has delved into the world of exchange traded funds, but there are other exchange traded products including exchange traded notes (ETNs). ETNs, one of the many exchange-traded products out there, are very different than ETFs. Most importantly, an ETN represents an unsecured liability on the part of its issuer (often a bank). If, for whatever reason, the issuer cannot make good on its obligations, investors in an ETN could suffer losses, even if they were correct in choosing a particular sector or market. Contrast this with ETFs, which are their own standalone structure, that hold securities on behalf of the fund’s investors.

ETFs are Here to Stay

From virtual obscurity a few decades ago, ETFs have become a household term. They have revolutionized the investing world, allowing individuals and institutions to access a wide variety of strategies in a low cost, tax-efficient manner. For its benefits, it seems a safe bet that the exchange traded fund is here to stay.

This resource is brought to you by NASDAQ

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2023. Nasdaq, Inc. All Rights Reserved.