ETF Market Risks

What is Risk, and Why Does It Matter?

Broadly speaking, risk in the investing context is the possibility that an individual or institution may not reach their goals. And there are many risks to be aware of, such as interest rate risk, geopolitical risk, and counterparty risk. Let’s put those portfolio threats aside and focus on the Investment/Market Risks associated with ETFs. There are a number of risk metrics investors can use to see whether or not a given ETF is meeting its objective. It’s important to know what these metrics are—and it’s equally crucial to understand what constitutes a good number, and what suggests cause for concern. To use a baseball analogy, knowing what slugging percentage represents is only half the battle—the savvy fan can put a player’s figure in context, making an informed conclusion as to how good a hitter someone truly is.

Is Your ETF Doing Its Job? The Importance of Tracking Difference

Although active ETFs have become more prevalent, the most popular funds are still passively managed. Whether or not a passive ETF increases or decreases in value, it’s crucial to know whether the fund is “doing its job.” In other words, is a given passive ETF reflecting its benchmark index, or meaningfully straying from it? This is where a metric known as Tracking Difference can be used. Tracking Difference is the discrepancy between ETF performance and index performance over a specified period of time. For passive ETFs, Tracking Difference is arguably the most important risk metric to follow.

![]()

Every ETF will have some element of Tracking Difference. For one thing, an ETF’s total expense ratio (TER) can always be expected to contribute to Tracking Difference, as it creates an exact drag on the fund’s performance compared to its index. In this vein, investors obviously benefit from a lower TER, as this minimizes the gap between an ETF’s performance and its benchmark index.

A Fund’s Tracking Difference Can Also Be Impacted by Other Factors, Such As:

• Cash Drag: In a bull market, a portfolio that holds cash will tend to underperform an index with no cash component.

• Sampling: Some ETFs engage in what’s known as “Full Replication”—owning all components of an index. Other ETFs, though, ‘sample’ a majority of the index components—owning most, but not all, of its securities. By not fully replicating an index, an ETF is exposed to Tracking Difference (positive or negative).

• Securities Lending: Many ETFs earn extra income by lending out shares to short sellers. On the one hand, this practice can improve a fund’s performance. However, there are a couple of risks. First, if a security that has been lent out soars in value and bankrupts a short seller, the borrowed shares may not be returned. This turn of events would mean the ETF would not benefit from the security’s jump in price, leading to underperformance relative to the index. To be clear, this is a rare event. To protect the lender from risk of loss, lent securities are always collateralized using cash or securities, commonly government debt. Cash collateral is more common in the United States, while Europe tends to favor noncash. This is common practice for ETFs.

• Trading Costs: When an ETF buys or sells securities (to re-balance, for example), it incurs trading commissions. These costs also cause the ETF’s performance to deviate from that of the index.

From Tracking Difference to Tracking Error

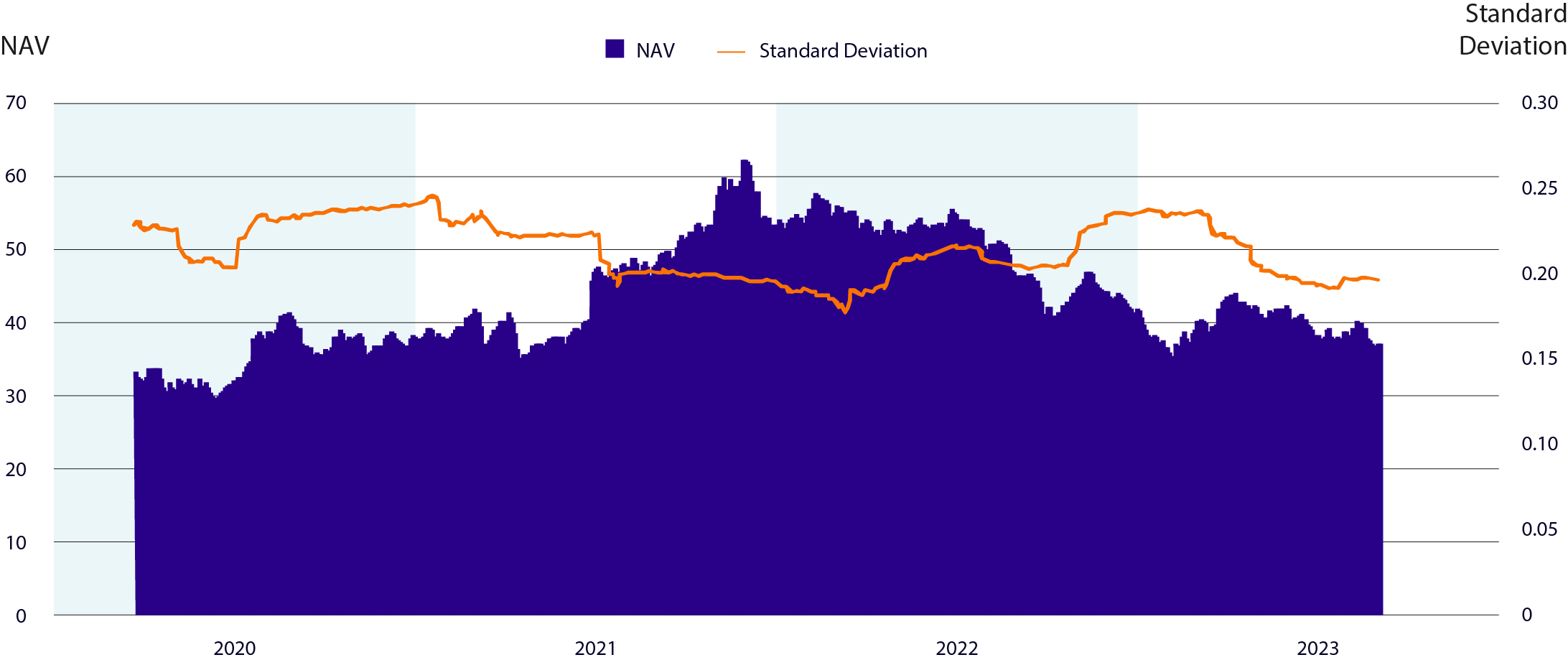

Tracking Difference is a measure of whether an ETF is keeping up with its index, but Tracking Difference fluctuates over time. That’s where a measure known as Tracking Error can be employed. Tracking Error is essentially the volatility of an ETF’s Tracking Difference. The lower the number, the better. Tracking Error shows you if the tracking difference is relatively consistent, or if it varies wildly over the course of the year.

Some investors conflate Tracking Difference with Tracking Error. They see a high Tracking Error and conclude that a given ETF isn’t properly following its index. In reality, the Tracking Difference may simply be low but volatile.

It’s important to note that, for the purpose of Tracking Difference and Tracking Error calculations, an ETF’s performance can be measured by price or Net Asset Value (NAV). Price is based on the perceived value of the fund by buyers and sellers in the market, while NAV is based on the prices of the underlying securities and their weights making up the fund. NAV may have fewer uncontrollable variables impacting its measure of performance, arguably making it the better choice.

Other Passive Measures of Risk

In addition to Tracking Difference and Tracking Error, there are two other key metrics used to measure ETF risk for passive ETFs: Beta and Standard Deviation.

Beta is a measure of an ETF’s volatility relative to the market. By definition, the overall market’s Beta is 1.00. An ETF with a Beta greater than 1.00 has exhibited more volatility than the market over a specified period of time. In contrast, an ETF with a Beta less than 1.00 has been less volatile than the overall market.

Beta is also a function of correlation: An ETF with a positive Beta (greater than 0) is positively correlated with the overall market, whereas an ETF with a negative Beta (less than 0) is inversely correlated to the overall market. Most passive ETFs will have a positive Beta. Sectors that tend to exhibit high levels of volatility will have a positive Beta greater than 1, and more defensive sector ETFs will have a Beta that is positive but less than 1. Examples of passive ETFs that may, depending on the market environment, have a negative Beta, include inverse ETFs (exchange traded funds that use derivatives to achieve the opposite returns of a specified benchmark), and government bond ETFs.

Standard Deviation compares the long-term average return of an investment to the shorter-term returns it achieved along the way. It’s common to look at the historical average returns of an investment when deciding if it’s a good opportunity. But average returns don’t tell the whole story. Suppose two ETFs both average a 7% return over the past 10 years. But when looking at individual years, one returned 7% every year while the other had some years with double-digit performance, and others with low single digit returns. Clearly, the ETF that rose 7% each year displayed lower volatility than its counterpart—and likely took less risk to achieve the same long-term return.

It’s crucial to note that Standard Deviation includes both upside and downside volatility. So, a high number could indicate increasing returns, decreasing returns, or a combination of both.

Active Measures of Risk

Passive ETFs may still dominate, but active products are becoming increasingly popular with investors. Fortunately, we also have measures of risk to assess these ETFs as well. As with passive ETFs, investors can use both Beta and Standard Deviation when judging whether an active product is meeting its objective.

In addition, there are two key risk metrics specifically applicable to active ETFs:

• Alpha: A measure of how an ETF performs relative to a particular index or benchmark over a specified period of time, after adjusting for volatility. Alpha offers a window into the ‘active’ performance of an ETF, allowing investors to see whether a fund is outperforming or underperforming a passive benchmark. This measure is expressed as a percentage. For instance, an ETF with an Alpha of 3% will have exceeded its benchmark by this amount, after taking into account the volatility of the fund’s portfolio.

• Sharpe Ratio: A measure of an ETF’s excess returns relative to its volatility. The Sharpe Ratio indicates how much excess return is generated per unit of risk taken, and a higher number implies that an investor is being compensated for taking on extra risk with relatively outsized returns. The Sharpe Ratio gives investors a sense of whether an active ETF fund is taking a substantial amount of risk in order to generate outperformance. Ideally, an ETF is delivering above average returns with low volatility. The Sharpe Ratio is also expressed numerically (the higher the better), with anything above 1 considered to be good.

Sidebar: Liquidity Risk

ETF investors are also faced with potential liquidity risk. This is especially true if a significant portion of a fund’s assets are concentrated in thinly traded securities. An ETF’s liquidity is tightly linked to the liquidity of its underlying holdings. As a result, a fund that has a large weighting in small companies with large bid-ask spreads and low volume will usually have poorer liquidity than a fund, which predominately owns large-capitalization stocks with tighter spreads and high daily volume.

Conclusion

ETFs have specific roles to play in an investor’s portfolio. There’s no guarantee that a given ETF will rise in value, as any number of market factors could lead to a decline. But whatever the market environment, it is crucial that the ETF is performing its role correctly. Investors should look at the key risk metrics for a given fund to see whether the ETF is truly “doing its job.” That can help determine whether it’s a hold, or if it’s time to sell and move on to a product more likely to meet their objective.

This resource is brought to you by NASDAQ

Distributed by NASDAQ CAPITAL MARKETS ADVISORY, LLC, a Registered Broker Dealer and affiliate of Nasdaq, Inc.

Investment Risks

Exchange Traded Products (ETPs) are types of securities that derive their value from a basket of underlying securities such as stocks, bonds, commodities, etc., and trade intra-day on a national securities exchange. Generally, ETPs take the form of Exchange Traded Funds (ETFs) or Exchange Traded Notes (ETNs). Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions.

Exchange Traded Funds (ETFs) are subject to market risk, including the possible loss of principal. The value of the portfolio will fluctuate with the value of the underlying securities. ETFs may trade at a premium or discount to their net asset value. ETFs may have underlying investment strategy risks similar to investing in commodities, bonds, real estate, international markets or currencies, emerging growth companies, or specific sectors.

Diversification is not a guarantee against loss.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2023. Nasdaq, Inc. All Rights Reserved.