REX Shares & Tuttle Capital Management Announce Forward and Reverse Split of Two ETFs

MIAMI —July 11, 2024 — REX Shares & Tuttle Capital Management (“T-REX”) have announced the execution of a forward share split of T-REX 2X Long NVIDIA Daily Target ETF (Ticker: NVDX), as well as a reverse share split of T-REX 2X Inverse NVIDIA Daily Target ETF (Ticker: NVDQ). The total market value of the shares outstanding will not be affected as a result of these corporate actions as outlined below.

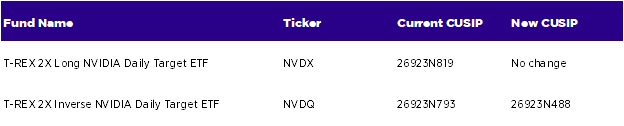

Please note the CUSIP changes, effective July 16, 2024:

Forward Splits

T-REX will execute a forward split of the issued and outstanding shares of T-REX 2X Long NVIDIA Daily Target ETF (Ticker: NVDX).

After the close of the markets on July 15, 2024 (the “Record Date”) the fund affecting forward split of the issued and outstanding shares as follows:

As a result of the forward share split, shareholders of the Fund will receive ten shares for each share held of the Fund as indicated in the table above. Accordingly, the number of each Fund’s issued and outstanding shares will increase by the approximate percentage indicated above.

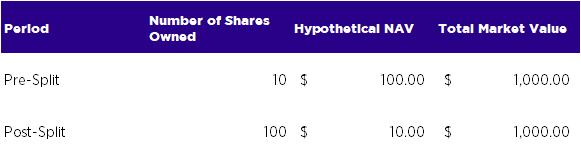

The share split will apply to shareholders of record as of the close of CBOE BZX (the “CBOE”) on July 15, 2024 (the “Record Date”). Shares of the Funds will begin trading on the CBOE on a split adjusted basis on July 16, 2024 (the “Ex-Date”). On the Ex-Date, the opening market value of the Funds issued and outstanding shares, and thus a shareholder’s investment value, will not be affected by the share split. However, the per share net asset value (“NAV”) and opening market price on the Ex-Date will be approximately one-tenth for the Fund. The table below illustrates the effect of a hypothetical ten-for-one split on a shareholder’s investment.

Illustration of a 10-for-1 Split

Reverse Split

T-REX will execute a reverse split of the issued and outstanding shares of the T-REX 2X Inverse NVIDIA Daily Target ETF (Ticker: NVDQ). After the close of the markets on July 15, 2024, the reverse split of the Funds issued and outstanding shares as follows:

As a result of the reverse split, every three shares of the Fund will be exchanged for one share, as indicated in the table above. Accordingly, the total number of the issued and outstanding shares for the Fund will decrease by the approximate percentage indicated above.

The share split will apply to shareholders of record as of the close of CBOE BZX (the “CBOE”) on July 15, 2024 (the “Record Date”). Shares of the Fund will begin trading on the CBOE on a split adjusted basis on July 16, 2024 (the “Ex-Date”). On the Ex-Date, the opening market value of the Funds issued and outstanding shares, and thus a shareholder’s investment value, will not be affected by the share split. However, the per share net asset value (“NAV”) and opening market price on the Ex-Date will be approximately three times the pre-split value for the Fund. The table below illustrates the effect of a hypothetical one-for-three reverse split on a shareholder’s investment.

Illustration of a 1-for-3 Reverse Split

Units Transfer

The Trust’s transfer agent will notify the Depository Trust Company (“DTC”) of the splits and instruct DTC to adjust each shareholder’s investment(s) accordingly. DTC is the registered owner of the Funds’ shares and maintains a record of the Funds’ record owners.

About REX Shares:

REX Shares is an innovative ETP provider specializing in alternative-strategy ETFs and ETNs. The firm created the MicroSectors™ and co-created the T-REX product lines of leveraged and inverse tools for traders. REX also manages a series of option-based income ETFs and has a total across all ETPs of $6.9 billion in assets under management.

Important Information

Investors should consider the investment objectives, risk, charges, and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the T-REX ETFs please call 844-802-4004 or visit our website at rexshares.com. Read the prospectus and summary prospectus carefully before investing.

The Fund is not suitable for all investors. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily leveraged (2X) and inverse (- 2X) investment results, understand the risks associated with leverage and the use of shorting and are willing to monitor their portfolios frequently. The Fund does not seek to achieve its stated investment objective over a period of time other than a single/ one trading day. The Shares will change in value, and you could lose money by investing in the Fund. The Fund may not achieve its investment objective. The Fund only intends to use reference assets that are traded on a U.S. regulated exchange. Investing in the funds is not equivalent to investing directly in NVDA as the fund will generally hold 0% of underlying shares.

The Funds’ investment adviser will not attempt to position each Fund’s portfolio to ensure that a Fund does not gain or lose more than a maximum percentage of its net asset value on a given trading day. As a consequence, if a Fund’s underlying security moves more than 50%, as applicable, on a given trading day in a direction adverse to the Fund, the Fund’s investors would lose all of their money.

INVESTMENT RISKS

Investing in the Funds involves a high degree of risk. As with any investment, there is a risk that you could lose all or a portion of your investment in the Funds.

Fixed Income Securities Risk. When the Fund invests in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund.

Effects of Compounding and Market Volatility Risk. The Fund has a daily leveraged investment objective and the Fund’s performance for periods greater than a trading day will be the result of each day’s returns compounded over the period, which is very likely to differ from the Fund performance, before fees and expenses.

Leverage Risk. The Fund obtains investment exposure in excess of its net assets by utilizing leverage and may lose more money in market conditions that are adverse to its investment objective than a fund that does not utilize leverage.

Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. Investing in derivatives may be considered aggressive and may expose the Fund to greater risks, and may result in larger losses or small gains, than investing directly in the reference assets underlying those derivatives, which may prevent the Fund from achieving its investment objective.

Indirect Investment Risk. Nvidia, Corp. is not affiliated with the Trust, the Adviser or any affiliates thereof and is not involved with this offering in any way, and has no obligation to consider the Fund in taking any corporate actions that might affect the value of the Fund. Industry Concentration Risk. The Fund will be concentrated in the industry to which Nvidia, Corp. is assigned (i.e., hold more than 25% of its total assets in investments that provide inverse exposure to the industry to which Nvidia, Corp. is assigned).

Counterparty Risk. A counterparty may be unwilling or unable to make timely payments to meet its contractual obligations or may fail to return holdings that are subject to the agreement with the counterparty. Shorting Risk. A short position is a financial transaction in which an investor sells an asset that the investor does not own. In such a transaction, an investor’s short position appreciates when a reference asset falls in value.

Liquidity Risk. Holdings of the Fund may be difficult to buy or sell or may be illiquid, particularly during times of market turmoil. Illiquid securities may be difficult to value, especially in changing or volatile markets. Non-Diversification Risk. The Fund is classified as “non-diversified” under the Investment Company Act of 1940, as amended. This means it has the ability to invest a relatively high percentage of its assets in the securities of a small number of issuers or in financial instruments with a single counterparty or a few counterparties.

New Fund Risk. As of the date of this prospectus, the Fund has no operating history and currently has fewer assets than larger funds. Like other new funds, large inflows and outflows may impact the Fund’s market exposure for limited periods of time.

NVIDIA Corporation Investing Risk — NVIDIA Corporation faces risks associated with meeting the evolving needs of its large markets – gaming, data center, professional visualization and automotive – and identifying new products, services and technologies; competition in its current and target markets; changes in customer demand; supply chain issues; manufacturing delays; potential significant mismatches between supply and demand giving rise to product shortages or excessive inventory; the dependence on third-parties and their technology to manufacture, assemble, test, package or design its products which reduces control over product quantity and quality, manufacturing yields, development, enhancement and product delivery schedules; significant product defects; international operations, including adverse economic conditions; impacts from climate change, including water and energy availability; business investment and acquisitions; system security and data protection breaches, including cyberattacks; business disruptions; a limited number of customers; the ability to attract, retain and motivate executives and key employees; the proper function of its business processes and information systems; impacts from the COVID-19 pandemic; its intellectual property; and other regulatory, and legal issues.

Important Information Regarding 2X NVDA Fund. The T-REX 2x Long NVIDIA Daily Target ETF (NVDX) seeks 2X% daily leveraged investment results and thus will have an increase of volatility relative to the NVDA performance itself. Longer holding periods, higher volatility of NVDA and leverage increase the impact of compounding on an investor’s returns. During periods of higher volatility, the volatility of NVDA may affect the fund’s performance.

Important Information Regarding -2X NVDA Fund. The T-REX 2X Inverse NVDA Daily Target ETF (NVDQ) seeks daily inverse investment results and is very different from most other exchange-traded funds. Longer holding periods and higher volatility of NVDA increase the impact of compounding on an investor’s returns. During periods of higher volatility, the volatility of NVDA may affect the fund’s return as much as, or more than, the return of NVDA.

Semiconductor Industry Risk — Semiconductor companies may face intense competition, both domestically and internationally, and such competition may have an adverse effect on such companies’ profit margins. Semiconductor companies may have limited product lines, markets, financial resources or personnel. Companies in the semiconductor industry may have products that face obsolescence due to rapid technological developments and frequent new product introduction, unpredictable changes in growth rates and competition for qualified personnel.

Technology Sector Risk. Market or economic factors impacting technology companies and companies that rely heavily on technological advances could have a major effect on the value of the Fund’s investments. The value of stocks of technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs.

Sector Concentration Risk. The trading prices of the Fund’s underlying securities may be highly volatile and could continue to be subject to wide fluctuations in response to various factors. The stock market in general, and the market for technology companies in particular, where applicable, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies.

Call Writing Strategy Risk. The path dependency (i.e., the continued use) of the Fund’s call writing strategy will impact the extent that the Fund participates in the positive price returns of the underlying reference securities and, in turn, the Fund’s returns, both during the term of the sold call options and over longer time period.

High Portfolio Turnover Risk. The Fund may actively and frequently trade all or a significant portion of the Fund's holdings. A high portfolio turnover rate increases transaction costs, which may increase the Fund's expenses.

Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price.

NAV: The dollar value of a single share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day.

Distributor: Foreside Fund Services, LLC, member FINRA, not affiliated with REX Shares or the Funds’ investment advisor.